CFD trading is a popular way to invest in various assets. Many investors who want to get into CFD trading have initial concerns. CFD traders follow a strategy that bets on the rise or fall of a financial product.

The Basic Knowledge

CFDs, also called contracts for difference, are a financial instrument. It allows to bet on rising or falling prices of stocks, foreign exchange, cryptocurrencies or commodities. By buying, investors do not acquire a direct stake, but bet on price changes. They are ideal for investors who are willing to take risks. Trading CFDs is easily accessible. It does not require high capital requirements, compared to other investments.

The Advantages

CFD trading is a popular choice for many investors because of its flexibility. It offers the opportunity to invest in various financial markets without having to physically enter the market. Investors buy or sell contracts that represent components of the underlying asset. When trading CFDs, the investor trades only a fraction of the actual value. There is the possibility of using leverage. Leverage allows to achieve high volatility with low capital investment. It offers the chance to achieve higher profits with much smaller means.

The Flexibility

Investing money in cfd stocks is flexible: investors can open both long and short positions to profit from rising or falling prices. Investors can make profits when the market falls or rises. There is no minimum trading amount in CFD trading. As long as the broker accepts the trading limits, investors can trade as much as they want.

The Function

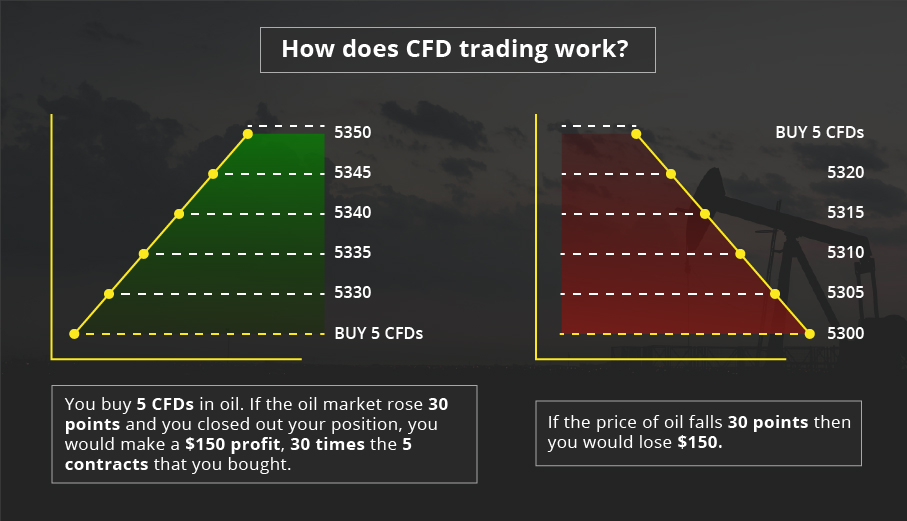

When trading CFDs, there is a contract between the broker and its trader. This connection ensures that the security trader receives the difference of the buying and selling price of the underlying asset. The investor has to deposit some percent as margin when placing an order. The broker provides the trader with the tools to help the investor place the order. Investors can use charts and technical indicators to estimate the market trends and identify profitable trades.

Uncertainty

There are risks involved in CFD trading. These are leveraged products. Small price movements have a larger impact on the investor’s account. Therefore, there is always the risk of a total loss of the invested capital. Moreover, investors must keep in mind that there is no direct ownership claim on the underlying asset. Instead, traders speculate on the price development. CFDs are traded as contracts for difference. Thus, the investor does not buy or sell a physical security. Therefore, it is advisable to inform yourself about all details in advance. Traders need a solid strategy for dealing with risks.

Order Placement

CFD traders can place both buy and sell orders. CFDs are quoted as a percentage and are based on the price of the underlying asset. The orders can be placed with a stop loss. This allows the investor to determine at what price movement the position should close. When placing a market order, the investor trades at the price available at the time of execution. A limit order determines at what order price the investor wants to execute the trade. A stop order closes the position when a certain price is reached. Traders can cancel or change orders as long as the broker has not yet executed the order.

Conclusion

In summary, CFD trading has many advantages. It offers flexibility, increased leverage and high potential profit margin. The return on a CFD depends on the performance of the underlying asset. It is advisable to learn about the market in advance. This includes understanding the different types of orders. Investors need a strategy to avoid losses.