From allowing you to cool down after a long and tiring day to spending endless hours of fun with your family members and friends, all the way to increasing the overall worth of your estate, there are various perks that come with having a swimming pool. However, installing one isn’t cheap, nor easy, which is why you might have started thinking about securing a loan.

After all, it will require anywhere from 25.000 to 100.000 dollars to install the pool, which is why you may be wondering – what credit score do I need to have in order to fund a pool? Fortunately for all homeowners that are wondering the same thing, the article below will shed some light on the entire topic. So, let’s take a closer look at what you need to know:

There are two financing options:

1. Home equity mortgages

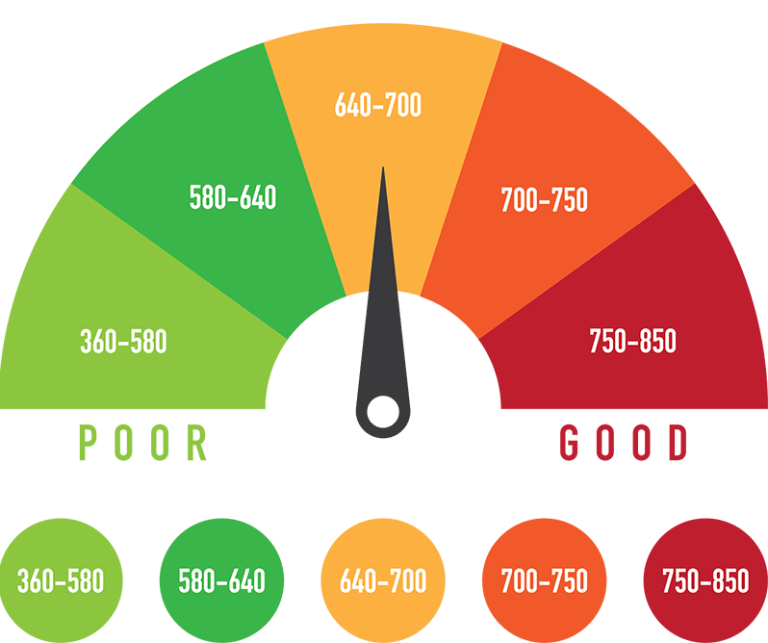

One of the first options that you can choose is to utilize your home’s equity for funding the installation of the swimming pool. Keep in mind, the minimum credit score will rely on the lending organization you opt for, however, the average score required is anywhere from 600 to 700 points.

You need to know, if you choose this financing option, your house and property will basically act as collateral, which means that, if you cannot repay it, your house could be foreclosed on. So, before you choose this type of financing, you should determine whether or not you can repay it.

2. Unsecured credits

Another option that you could choose is an unsecured loan. When compared to the aforementioned option, this one won’t require you to risk losing your house, and as the name implies, they aren’t tied to any of your assets. What will happen if you cannot make the payments?

Well, if you don’t repay an equity debt, you’ll be held responsible, however, if you don’t repay an unsecured credit, the lending organization will be responsible. This is also one of the reasons why the minimum score is higher for this option, and it varies from 640 to 750. Additionally, the interest rates will also be higher.

FAQ: Answered

1. Can i obtain funding with a low score?

So, as you were able to learn, your credit score needs to range from 600 to 750 points. But, what happens if your credit score is lower than 600, can you still qualify for credit? To put it simply, you can still secure it, however, it will take a little bit more effort to do so.

The lending organizations won’t only look at the score you have, instead, they’ll look at your entire credit history. Hence, even if you do have a sum of 550 points, having a clean history will improve your odds of qualifying and obtaining a loan. You might need to put off the installation for a while until you improve your points, which is something that you can do in several months.

2. How can I calculate the payment I need to make every month?

Let’s say that you’ll be taking out a 30.000 dollar credit that you’ll return in the course of two decades. If so, you’ll be required to pay less every month and in this scenario, the payment will be approximately 140 dollars. On the other hand, if you choose a higher value credit such as 50.000 dollars, you could expect to give around 225 dollars every month.

Luckily, there is a wide range of online platforms, tools, and programs that could assist you with calculating the monthly fees you would have in different scenarios. This means that you could learn what the monthly payments would be for different loan amounts and you can click here to use an online calculator right away.

3. What information will I need to submit?

In most situations, a lending organization will require you to present your social security number, your driver’s license, your current job position and status, the income sources, total housing expenses for a month, your house equity, as well as any liquid and retirement assets that you may have. Keep in mind, some might lenders might not ask you for all of this data, while others might require some additional information.

4. Could I finance a part of the project with a loan?

A lot of homeowners don’t know that they can finance part of their project with a loan. There are various situations where the homeowner funds most of the materials and installation expenses, and choose to finance the landscaping, patio, as well as other accessories in order to repay it quickly.

5. How long will it take to secure the loan?

This will depend on the options you choose. For instance, if you choose an unsecured one, it’ll take approximately five to seven days, while a secured loan will take up to four to six weeks. This is why a lot of experts recommend that you gather all the necessary information on time, mostly because it can speed up everything.

6. Will it increase my property value?

Any type of improvement done to your property will increase the overall worth of your property and installing a swimming pool in your yard is no different. Hence, if you’re planning on selling your home in the future, you’ll be capable of selling it for a higher price than you otherwise would. Keep in mind, the pool needs to be in good condition in order for you to get a maximum ROI, hence, ensure that you maintain it properly and frequently.

Conclusion

As you can see, there is a wide range of things that you could do in order to secure financing for installing a pool in your backyard. Besides choosing two of the aforementioned options, you could also work on your credit score in order to ensure that you could secure a loan quickly.

So, now that you have learned more about pool financing, you shouldn’t lose any more of your time. Instead, you should determine which financing option is suitable for you and then you should start looking for a lending organization that’ll provide you with the financing you need.