As the 2024 U.S. elections approach, some speculate that it could send shockwaves through the digital assets market. But is the connection between U.S. politics and the cryptocurrency market as straightforward as it seems? Let’s break down the dynamics to see what factors may impact prices, investor sentiment, and, ultimately, the value of your favorite tokens.

Key Points:

- Political events influence market volatility.

- Voters’ expectations can shape economic outcomes.

- Cryptocurrency policy trends can swing prices.

- Potential crypto-friendly or unfriendly leaders may impact the market.

- Investor interest grows with clearer regulations.

Election Hype and Cryptocurrency Prices

Every major election season brings waves of speculation and heightened interest. During election periods, investors closely watch both U.S. and global markets, as shifts in leadership often shape future economic policies. When it comes to cryptocurrency, the stakes are unique, mainly due to the delicate relationship between traditional regulations and digital assets.

For example, the potential for new policies or regulatory shifts often sends crypto enthusiasts into a frenzy, with some seeing elections as a gateway to either major growth or temporary setbacks. The approach to cryptocurrency varies significantly across political lines, which adds a bit of drama to each election season. Investors often speculate wildly on how candidates’ stances might influence prices. And in a world where regulations can quickly swing, who takes office matters more than ever for those who’ve invested in digital assets like Bitcoin or Bitake (바이테이크).

Could Election Results Spark a Bull Run?

Could the outcome trigger a major spike in prices? It’s possible, especially if a leader openly supportive of crypto assets takes office. When a candidate shows favor towards policies like crypto adoption or taxation reform, it can ignite confidence among investors. Those who have seen value in digital assets often hold on to the idea that a favorable candidate could mean fewer restrictions and more room for growth.

However, it’s not all rainbows and unicorns. Election outcomes don’t always lead to a clear bull run. Sometimes, shifts in power bring uncertainty, with investors holding back in response to potential policy changes. The impact of regulations can’t be underestimated. For some, a pro-crypto leader brings hope; for others, it brings fear of overly restrictive policies that may harm market potential.

What Kind of Leadership Drives Positive Market Sentiment?

Different leadership styles send unique signals to the markets. While some focus on regulation and oversight, others emphasize innovation and tech-driven economies. The kind of leadership that has historically fueled the digital asset market is one that encourages innovation without overly restrictive measures.

- Pro-innovation candidates – Leaders who see value in fostering tech and blockchain innovation often attract crypto supporters. Their emphasis on growth can lead to a more welcoming environment.

- Tax reforms favoring crypto – Clear tax structures and lower taxation on digital assets can attract investments. When investors feel secure about the tax implications, interest grows.

- Financial system reform – Candidates pushing for changes to the financial system, particularly those promoting digital solutions, often capture the interest of crypto enthusiasts.

The right mix of innovation-friendly policies and minimal restrictions tends to foster optimism in the market, especially as election season heats up.

The Power of Regulatory Clarity

One of the biggest challenges facing the market lies in the lack of regulatory clarity. Over the years, policymakers have been unclear or inconsistent, creating market instability. A clear framework, however, allows for informed investment choices. During elections, candidates who prioritize regulatory clarity often gain favor with the crypto community.

Consider how secure investors might feel if a candidate announces plans to outline specific, transparent regulations around digital currencies. Without the fear of sudden crackdowns, more people might be open to investing. That confidence can stabilize the market and could even lead to a long-term increase in prices.

How Investor Psychology Influences Price Movements

Market psychology often plays a bigger role than policies themselves. When confidence is high, prices tend to climb; when it’s low, they drop. Political campaigns and candidates’ public statements affect investor psychology significantly. Speculators tune into speeches, interviews, and debates, searching for signs of crypto-friendliness or policy rigidity.

During election periods, each word matters. A single statement from a candidate can shift markets, sparking waves of buying or selling. Take, for example, a candidate signaling support for the use of blockchain in government processes. That single remark can set off a buying frenzy. Conversely, a promise to impose tighter restrictions may lead to a sell-off.

The back-and-forth between bullish optimism and cautious pessimism makes for a volatile market, especially as election day draws near.

History’s Lessons on Elections and Cryptocurrency Trends

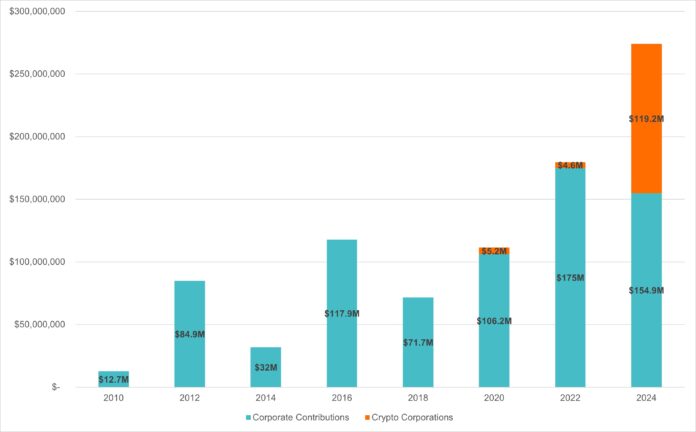

History has shown that political events, especially elections, can influence market trends. Previous elections saw a rise in prices, largely driven by hype and the hope of crypto-friendly policies. In 2020, for example, Bitcoin’s price saw a significant uptick, partially fueled by hopes for regulatory acceptance. With more investors considering digital assets a viable alternative to traditional markets, the trend may continue.

Many attribute these spikes to expectations rather than policy changes. People tend to buy on optimism and sell on the reality of implementation. This makes election periods particularly volatile, with prices reacting to the mere possibility of favorable conditions.

The Impact of New Voter Demographics on Crypto Adoption

As younger generations vote in higher numbers, the focus on digital assets may grow. Many young voters lean towards candidates who support tech advancement. Their votes could tip the scales toward a pro-crypto candidate, sparking higher interest in digital assets. This influence can not only drive policy but also affect prices.

In short, voter demographics play a crucial role in shaping market sentiment. A surge in young, tech-savvy voters increases the chances of cryptocurrency adoption. Political figures aware of this trend often adapt to meet the demands of a digital-first voter base, creating a more favorable environment for crypto assets.

What to Watch for in Election Season

With so many moving parts, where should you focus your attention during the election period? Consider the following elements:

- Candidate speeches – Are they signaling support for blockchain and digital innovation?

- Campaign promises – Look for specifics on tax reform and innovation-friendly policies.

- Market reactions – Watch for fluctuations in Ethereum and Bitcoin prices around debates and announcements.

- New demographic influence – Keep an eye on the role of younger voters pushing for digital asset policies.

By focusing on these elements, you can gain insight into how the market may react as election season unfolds.

Final Thoughts: A Bull Run or Just More Volatility?

As we look toward the future, there’s no guarantee that the upcoming election will lead to a full-fledged bull run. But one thing remains clear: politics and digital assets are becoming increasingly intertwined. The level of influence candidates have on markets will continue to grow, especially as blockchain becomes more mainstream.

Whether you’re an investor or simply curious, election periods are a time to watch for possible gains, increased interest, and, yes, the occasional price dip. With each candidate having a different approach to digital assets, market watchers can expect a mix of optimism and skepticism, with prices reflecting the mood of the times.

As 2024 approaches, all eyes are on the candidates and their potential to shape the future of finance. Whether it’s a bull run or a rollercoaster, one thing’s for sure: there will be excitement, volatility, and possibly a chance to ride the wave of optimism into a more crypto-friendly future.